|

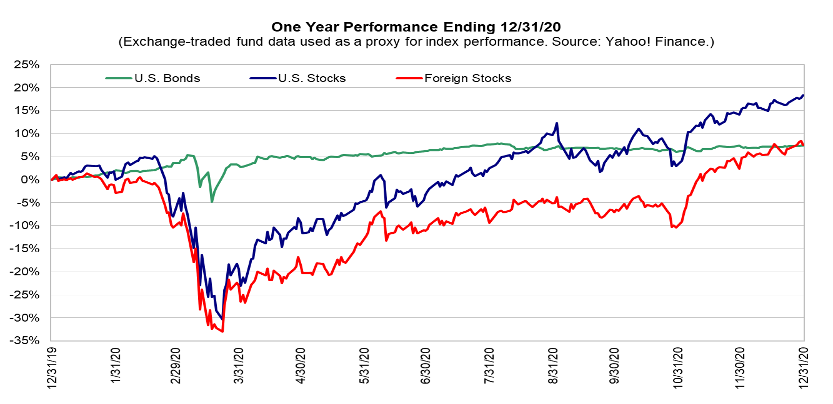

Happy New Year! This was certainly a year we are happy to see in the rear-view mirror. While there is still a bit of work to do, we’re hopeful for the future. As we write this, we are still in the middle of the pandemic albeit one with a way forward as the vaccine administration gets underway. Somewhere between now and mid-year we’ll hopefully have enough folks vaccinated to start to see measurable progress in containing the virus and a consequent loosening of the many parts of the economy that have been held hostage. As surprising as the reach and scope of the economic pain from the pandemic has been, the market reaction has been just as surprising. A sharp selloff in the spring turned into a robust rebound in share prices as investors lifted their attention from the all too grim present and began to concentrate on the shape of the future If there was ever a compelling set of events to use as caution against trying to time the market this year provided just that. Folks that tried to sell on the way down were confounded by the sheer velocity of the downturn and those that sold in March missed an awful lot of gains before events would lead them to feel comfortable enough to re-enter the market. As is our tradition for this time of year, we will take a couple of pages to give you a blow-by-blow of the major asset classes in your portfolio; what they have done, what we anticipate going forward, and how we have approached each. Whether you are a long-time client or a recent addition to our extended client family, we hope you will find this helpful. Bonds Taking a page from their playbook during the Global Financial Crisis over a decade ago, the U.S. Federal Reserve decided to again engage in maximum monetary accommodation in an effort to stem economic damage caused by the Covid-19 pandemic and help with an eventual recovery. This took short-term interest rates down to zero and kept the bond-buying program in place to restrain long-term rates as well. The bellwether 10-year treasury note yield fell from 1.9% at the year-end 2019, to just under 1.0% by the end of this year. Despite starting with already-low yields in relative terms, this further decline in yields and tightening of interest rate spreads for corporate bonds resulted in strong total returns for most portions of the fixed income market. We came into this year with the bond allocations of your portfolio in normal proportions to each other. Early in the year, before the pandemic started to take its toll, we leaned into U.S. government bonds as the differences in yield between corporate and government bonds didn’t favor the extra risk inherent in corporate debt. In March, however, as the potential economic damage from the pandemic weighed on financial markets, and more attractive credit spreads resurfaced, we reversed this positioning and raised corporate bonds back to a neutral weighting. Stocks As mentioned above equity markets experienced quite a roller-coaster ride in 2020. After beginning the year seemingly near fair value, and the prior business cycle gradually slowing, the Covid pandemic gained steam and the resulting economic uncertainty battered equity prices. The resulting peak-to-trough decline of -33% for the S&P 500 was the most severe since the 2008 financial crisis. Almost as surprisingly, the 65% recovery from these lows in the ensuing months was also rapid from a historical standpoint. This upturn was aided by extreme levels of global government fiscal and monetary stimulus efforts, despite several challenging waves of Covid infections. November brought one of the best months in recent memory, as results from vaccine trials were announced. U.S. and foreign stocks showed similar recovery patterns during 2020, not unexpected given that global sentiment was driven by both the severity of the spread of Covid, government stimulus efforts, as well as news regarding vaccine progress. However, U.S. stocks outperformed foreign by about 10%. Domestically, higher-quality growth assets, such as technology, communications, and consumer stocks fared best during social lockdowns, as many workers worked and shopped from home; energy stocks lagged due to continued weak demand for petroleum. Later in the year, as signs of an end to the pandemic became more apparent, a bit of a reversal was seen as cyclical assets and smaller companies outperformed. Our portfolios entered the pandemic with a distinct emphasis in large US stocks and that worked well for much of the year as economic uncertainties held back the recovery of smaller company shares for some time. In the fall, due to higher valuations for U.S. large cap stocks and more favorable metrics for mid- and small-cap names, we shifted this emphasis slightly, reducing large US holdings and bringing the small and medium company allocations back toward normal. Real Estate Real estate in both the U.S. and foreign markets suffered negative returns in 2020, as Covid restrictions challenged fundamentals in a variety of core sectors. Due to an obvious lack of consumer activity and work-from-home trends, retail and office were especially affected as concerns over the pandemic’s duration along with fears over potential softness in tenant rent payments took top priority. Other segments, such as data centers and cell towers fared quite well, however, as fundamentals improved with higher digital usage. Commodities Commodities experienced a difficult stretch for the majority of 2020, although prospects improved later in the year with better clarity on a possible end to the pandemic and resumption of normal economic activity and trade. Crude oil prices were especially hard-hit, as a glut of supply was combined with sharply weakened demand from curtailed production and travel. Industrial metals recovered to earn double-digit returns, as China’s experience with Covid ended earlier than in most other regions, and industrial activity resumed. Precious metals earned even stronger returns as investors sought safety early in the year, and concerns festered about the amount of monetary stimulus offered by the world’s largest governments. Outlook Economic growth is the fuel that propels stock market returns over time. The anticipation of that growth (or lack thereof) is the driver of shorter-term market movements. Let’s look at each in turn. We’re not out of the woods yet but expectations for growth going forward are generally positive. This last economic downturn was purely a function of the pandemic and the rebound in the economy will continue as the pandemic is brought under control. It is expected that growth will continue to struggle early in the year but be more robust later as the virus abates and as we all adjust to the post-Covid reality. Of course, the recovery won’t bring us immediately back to where we were in 2019 and we’ll have winners and losers as we all adapt to the new situation we find ourselves in. But in general, mainstream economists expect a continued recovery in the broader economy this year and next. The markets have been anticipating this rebound for some time. The sizable climb from the market bottom back in March was based on expectations for an eventual end to the pandemic. This anticipation brought market valuations from a bit above normal at year end 2019 to an even higher plateau as we closed out 2020. The extremely low current interest rates are supportive of those higher valuations to some extent but even factoring in those levels equity valuations, especially in the US, seem a bit rich. For long-term investors the future looks reasonably bright. There is every expectation of a continued improvement in the economy and that improvement will translate into more jobs and higher corporate earnings over time. Those higher earnings will help the market grow into its current valuation. The implications for modest market returns over the next few years seem generally positive. After the last two surprisingly robust years, incremental returns for the next couple would not be surprising. The path to get there may be more roundabout however. We’re likely to see volatility as bulls and bears parse the tea leaves and contemplate continued uncertainty about the shape and size of the recovery. While increasing earnings over time will help us grow into current market valuations a pullback in shares could have a similar effect. Only time will tell us the short-term trajectory of the markets over the next period but we can safely say that market volatility of some degree will certainly continue this year. The most important antidote to portfolio volatility is diversification, especially regarding macro allocations between stocks and bonds. This is a great time to consider overall allocations in light of income needs and other projected cash flows. We wish the very best for you and your family in 2021. We do not provide legal or tax advice. Readers should consult their own legal or tax advisor. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. Investors should talk to their financial advisor prior to making any investment decision. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Comments are closed.

|

AuthorCultivant team & Archives

September 2023

Categories

All

|

|

Advisory services offered through CS Planning Corp, an SEC registered investment advisor.

Insurance products offered through Elliott Bay Insurance LLC. Form CRS, Privacy Policy, and Additional Disclosures. |