|

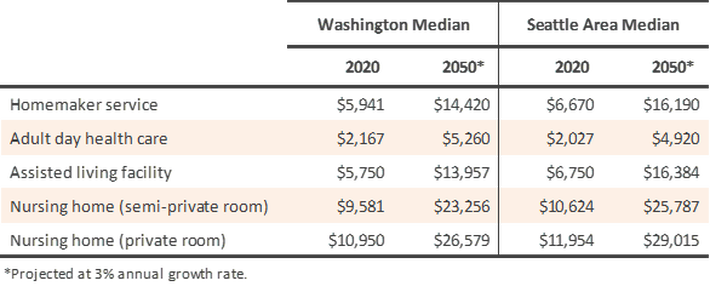

In our previous post, we discussed pricing and product options of long-term care insurance. Today, we will look at what’s involved in underwriting, and some sobering statistics related to long-term care. UNDERWRITING The process of applying for long-term care insurance is itself relatively straightforward. For starters, there’s paperwork, of course. Then it generally involves only a phone interview and you typically won’t get a visit from a nurse for an exam. There are exceptions, however. For example, if you haven’t seen a doctor for the past 24 months, the insurance company might require a paramedical exam with blood and urine samples. A phone interview involves asking questions about your medical history, but the interviewer is also trying to assess your cognitive functions as you interact with them. You may have applied for life insurance and be familiar with life insurance underwriting. Underwriting for long-term care insurance is a little – at least from the perspective of the person doing the underwriting. With long-term care insurance, the underwriter evaluates your morbidity (vs. mortality for life insurance). Okay, you probably intuitively understand what mortality means. It has to do with dying and you are applying for life insurance. You can connect the dots. But what in the world is morbidity? Morbidity has to do with the state of being diseased or unhealthy. Think of fragility related to aging – high blood pressure, high cholesterol, extra pounds, arthritis, joint problems, cognitive decline, and so on. As we live longer, these health issues can become more pronounced. And they may eventually lead to inability to perform some activities of daily living like bathing and dressing. As an aside, we ask our clients to complete a health prequalification form. This has helped minimize surprises and disappointments, and save time for everyone. COSTS OF CARE Our focus so far has been on long-term care insurance. After a while, it can become just a theoretical exercise involving numbers. So let’s look at what costs of long-term care are? According to Genworth Costs of Care Survey, the 2020 median monthly costs of care for our home state of Washington are: Not surprisingly, costs of care are slightly higher for the Seattle area than the state as a whole. Numbers may be different in your state, but we can be sure of two things. One, it’s expensive. Two, it’s more expensive in cities than it is less populated areas. STATISTICS ON LONG-TERM CARE Statistics on long-term care are quite sobering. You can read more about it in the Morningstar website, but here’s a sample:

Well, that just about wraps up our series on long-term care insurance. I hope you found it helpful. We do not provide legal or tax advice. Readers should consult their own legal or tax advisor. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. There is always the risk that an investor may lose money. A long-term investment approach cannot guarantee a profit. Investors should talk to their financial advisor prior to making any investment decision. This information is intended for educational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services.

Comments are closed.

|

AuthorCultivant team & Archives

September 2023

Categories

All

|

|

Advisory services offered through CS Planning Corp, an SEC registered investment advisor.

Insurance products offered through Elliott Bay Insurance LLC. Form CRS, Privacy Policy, and Additional Disclosures. |